While you may sell your home at any time its typically a good idea to wait at least two years before putting it. No Realtors No Repairs or Cleanup Necessary.

4 Tips To Sell Your Home Quickly Real Estate Tips Real Estate Quotes Home Selling Tips

Get Your Free Estimate Now.

. Referencing back to the original problem yes you can sell your home at any time but you might run into the 6 month rule as a problem depending on who your lender is. On average this selling price is 106 of the list price. But any time that you resell a property within the first six months of initial ownership you may lose money on the deal.

How soon can you sell a house after buying it and make a profit. Market conditions can make or break how soon you can sell a house after buying it. If you sell your home within two years of purchase you will need to pay taxes on the first 250000 that you make from the sale of your home.

Unless its a. Unfortunately youll need to do this again when you sell. If you purchased your property as a foreclosure or a short sale and are able to sell it under regular conditions you may be able to make a return on your investment.

Thats short-term capital gains. Youll have to pay a short-term capital gains tax if youre selling less than a year after buying. The bottom line about how soon you can sell your property.

When you sell your house youre not just getting back more or less than what you paid for it. Most experts say there is a five-year rule when choosing when to sell a home after buying it. A home usually takes five years to appreciate enough so that youll break even on all your costs when you sell again.

You can anticipate buyer closing costs to cover 2-5 of your home purchase price. You may have also depleted your savings to make a down payment. Nov 11 2019.

This unofficial guideline indicates that homeowners should live in their homes for 5 years before selling them to be financially viable. Either way though you can crunch the numbers so youre sure. Lets take a look at a few costs you can expect to deal with when selling a house quickly after buying.

In the world of real estate the famed five-year rule is often taken as a governing principle when it comes to buying a house. Yes you can sell a house soon after buying it while still making a profit. Basically it says you should never even consider selling until youve lived in the home for at least five years.

In general its good to give yourself roughly two to three years before selling as this tends to be the usual breakeven horizon. Yes you can sell your house after one year or less. Ad Find Expert Realtors to Help Sell Your House for Top Dollar Fast.

However if the market is slow it will take longer to get an offer. You own the property and you always have the legal ability to sell the property at any time after closing. You will likely have to eat all of these costs unless you are able to sell your new.

The rate will depend on your capital gains tax bracket. So the safest answer to the question of how long should you own your home before selling is five years. Technically you could even sell it the day you purchased it.

At the end of the day if you really want to you can sell your property the very next day after you purchase it. Ad HomeLight Buys Your Home As-Is In Select Markets. But while there arent any legal restrictions on how quickly you can sell there will likely be some financial ramifications.

It is common for buyers to ask the seller to cover the closing costs so keep this in mind. Seller closing costs can be 8-10 of the sale price with the majority being paid out in commissions to. Still this is not a hard and fast rule and there are benefits to selling earlier which we will discuss later in this article.

As long as the sale is official and the house is legally yours nothing is stopping you from selling it right away. Subtract the closing costs from your potential sell price. If youre putting your house up for sale more than a year after buying but less than two years you will have to pay a long-term tax rate on any profits.

If you recently bought your home you probably shelled out 2 to 5 of the purchase price for closing costs unless you negotiated for the sellers to pay them. If you are part of a couple that amount increases to 500000. For example the closing costs loan origination and appraisal fees down payments on insurance and taxes that you started accruing as soon as you made the purchase.

Ad As Seen On CNN CNBC Fox News. This will depend on the market conditions and could take 2-5 years. You will need to cover not only the house price you paid but epc charges agent fees and legal fees before you breakeven or make a profit.

Figure out the fair market value Use an online site or hire someone who will appraise your homes value. Not everybody can break even in 5 years so the 5-year Rule does not always apply. Save Time Hassle.

Although this is rare some lenders include a prepayment penalty clause. If youve lived in the house more than one year but less than two youll be paying capital gains taxes at a little better rate but its still. If You Decide To Accept The Offer You Can Pick the Move Date.

This makes selling difficult unless you find a cash buyer. Not only that but closing costs for sellers are also higher. Can I sell my house after one year or less.

If you buy a house and need to sell it soon after you could encounter any of the following delays. First lets consider how much it. The simple answer to this question is that you could immediately sell your house after closing if you really wanted to.

And its not arbitrarytheres good reason for it. But even if the value of your home has increased some homeowners still learn the hard way that there are some surprising losses you could suffer. There are plenty of other costs direct and indirect involved in the process that might impact your decision to sell.

Well the good news is that you can sell your house immediately after buying it but it does come at a price. But if you can sell sooner you could avoid higher capital gains taxes due on the profit you make on your home. According to this rule homeowners are urged to stay in the property they purchased for at least five years after acquiring it or risk significant financial losses in the process.

As a homeowner wondering can you sell a house within six months of buying it the answer is always. A premature sale means you need to sell less than a year after buying and in this case youre taxed as regular income on the sale according to your tax bracket. If the market is strong homes will sell for more than their listed value in about 50 days.

Several real estate professionals advocate following the 5-year rule when reselling your house. The six-month rule many mortgage companies will not approve an application to purchase a property if the current owner bought it less than six months ago. Trusted by 989419 Home Sellers.

How To Sell Your House Fast Selling House Sell Your House Fast Things To Sell

What Comes After A Seller Accepts Your Offer Infographic Real Estate Infographic Real Estate Tips Real Estate Marketing

7 Cost Nothing Tips To Sell Your Home Faster Selling House Home Selling Tips Sell Your House Fast

Widow Puts Her House Up For Sale Investor Offers 450k Without Looking At The Lot Is Horrified After Seeing It When The Deal Is Done In 2022 Things To Sell Home

When Is The Right Time To Sell In 2022 Things To Sell Home Selling Tips The Time Is Now

What To Look For When Buying A House Home Buying Tips Moving House Tips Home Buying

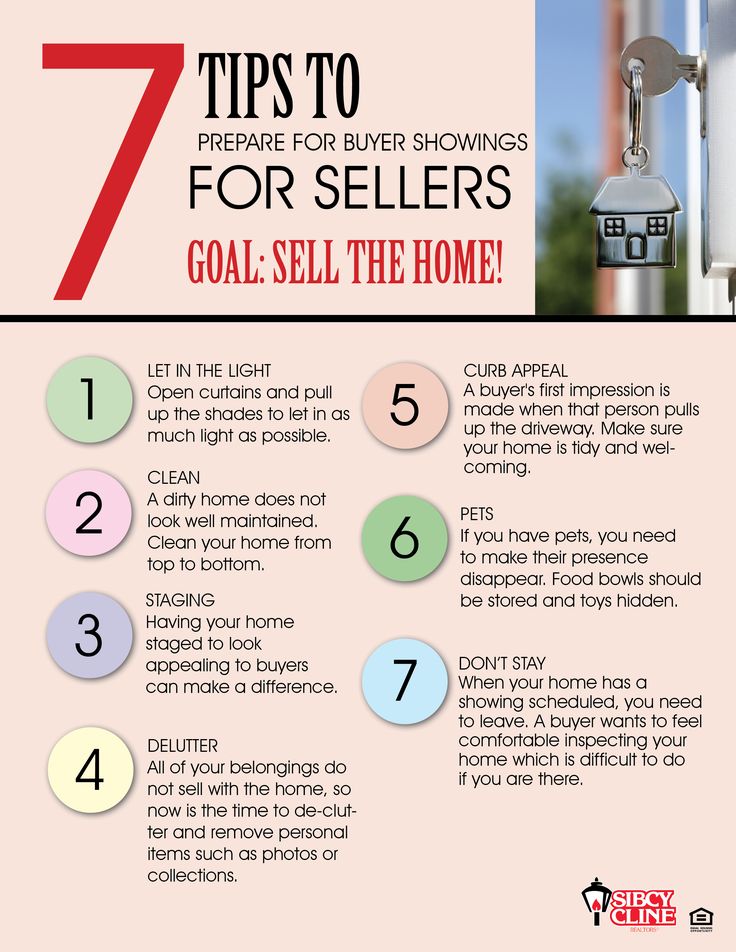

Tips To Get Your Home Prepared For Showings When Selling It Real Estate Tips Real Estate Advice Selling House

Pin On Nutley Nj Real Estate Nutley Homes For Sale Www Homesinnutleynj Com

0 comments

Post a Comment